Why Choose Us?

Competitive Rates

With access to multiple lenders, we provide you with the most competitive rates in the industry.

Honesty & Transparency

We pride ourselves on clear and open communication, ensuring you are informed and confident in your decisions.

Community Focused

Our commitment to the community is reflected in our active participation and support of local initiatives.

Friendly Service

Our team is dedicated to providing a warm, welcoming, and supportive experience for every client.

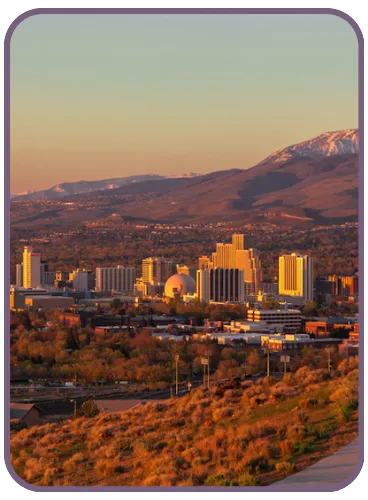

Community Involvement

We are deeply committed to giving back to the local community. Sage Home Lending believes in being an active participant in the neighborhoods we serve. Whether it's through charitable donations, volunteer efforts, or community events, we strive to make a positive impact and support the growth and well-being of our community.

Our Philosophy

At Sage Home Lending, we embrace the philosophy of "survival of the friendliest." We believe that fostering a culture of kindness, cooperation, and empathy is key to building lasting relationships with our clients and partners. Our team is here to support you every step of the way, offering guidance and expertise with a friendly and approachable attitude.

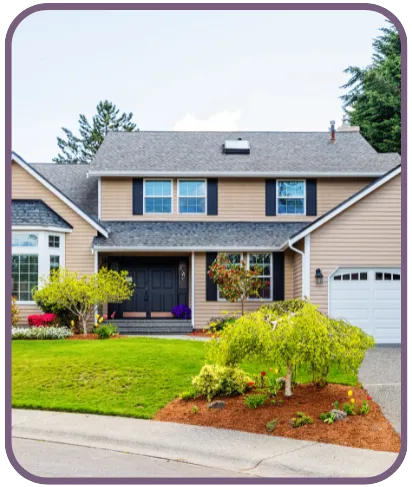

Join The Sage Home Lending Family

Whether you're a first-time homebuyer or looking to refinance, Sage Home Lending is here to help you achieve your homeownership dreams. Contact us today to learn more about our services and how we can assist you in finding the perfect loan.

Whether you're a first-time homebuyer or looking to refinance, Sage Home Lending is here to help you achieve your homeownership dreams. Contact us today to learn more about our services and how we can assist you in finding the perfect loan.

Partner with us for a stress free and painless process for buying or refinancing your home

Program Highlights

Down Payment Assistance Programs

First Time Home Buyer Programs

Conventional

FHA

Reverse Mortgage

Down Payment Assistance Programs

First Time Home Buyer Programs

Conventional

FHA

VA

USDA

12 Month Bank Statement

No Income Loans

VA

USDA

12 Month Bank Statements

No Income Loans

Ready To Get Started?

Take the first step towards your dream home. Apply for a loan with Sage Home Lending today and experience a seamless, transparent, and personalized lending process.

Take the first step towards your dream home. Apply for a loan with Sage Home Lending today and experience a seamless, transparent, and personalized lending process.

Frequently Asked Questions

What can I do if I only have a small down payment or none at all?

Some loans will allow you to secure just a 5% down payment plus closing costs. Another similar loan option is called a piggy-back loan where you get approved for the first and second mortgage at the same time to avoid PMI. You could also apply for a FHA loan which only requires you to put down 3.5% down. Your interest rate will probably be higher, and you will be required to buy private mortgage insurance (PMI).

What is private mortgage insurance (PMI) and do I need it?

If the bank or mortgage company determines that your loan is a risk, they may require private mortgage insurance. This insurance serves to insulate the lender in the event that you default on your loan. It is possible that the fair market value of your house will not cover the full amount of money owed to the bank or mortgage company if you default. In such cases, private mortgage insurance reimburses the lender for the difference. Private mortgage insurance is usually required for borrowers that make a down payment of less than 20% or with poor credit scores.

Do I qualify for a government loan?

The two primary federal government financing programs for mortgages are VA loans and FHA loans. VA loans are not actually loans, but a guarantee from the federal government that should you default, the U.S. Department of Veterans Affairs will pay the lender a certain amount of the defaulted loan. These loans are available to current members of the military and veterans with honorable discharges. FHA loans are available through the U.S. Department of Housing and Urban Development (HUD). These loans, like VA loans, guarantee that the Federal Housing Authority will pay the lender 100% of the insured amount of your mortgage should you default. You must meet certain criteria to qualify for an FHA loan.

Is a fixed-rate or adjustable-rate mortgage better?

Fixed-rate mortgages make sense for buyers when the current mortgage rate is low. This allows you to lock in the current rate and be protected from increases that are likely to take place over the next 30 years. If the current rate is high, an adjustable-rate mortgage may be better because rates can drop. It is good to remember that you will have the option to refinance in the future to take advantage of rate changes as well.

What are mortgage brokers, lenders, and loan officers?

Explore Site

Useful Links

Copyright 2025. All Right are Reserved. Sage Home Lending

Company NMLS 2558396